Corporate income tax rate less deductions for. 58 583 28 of the amount above 550 000.

Tax Brackets 2019 Tax Brackets Bracket Tax

The corporate tax rate applies to your businesss taxable income which is your revenue minus expenses eg cost of goods sold.

. Rate of Tax R 1 83 100. Before 1 October 2019 the national local corporate tax rate was 44. Company with paid up capital more than RM25 million.

The Corporation Tax rate for company profits is 19 You pay Corporation Tax at the rates that applied in your companys accounting period for Corporation Tax. The local corporate special tax which is. 365 001 550 000.

7 rows At Spring Budget 2021 the government announced an increase in the Corporation Tax main rate. Corporate - Taxes on corporate income. Last reviewed - 13 June 2022.

Corporation tax rates Federal rates The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement. Sub-central government corporate income tax rate. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region.

C For all new manufacturing domestic companies As per section 115BAB Income Tax Rate. Example Lets say you have annual revenues of 250000 and qualifying expenses of 55000. The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with taxable income over 10 million.

After the general tax reduction the net tax rate is 15. For promoting growth and investment with effect from financial year 1 April 2019 till 31 March 2020 FY 2019-20 any domestic company which opts for not availing any exemption or incentives shall be liable to a reduced income-tax rate of 22 percent. Corporate income tax rate exclusive of surtax.

KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Provincial or territorial rates. 550 001 and above.

This allocation is generally made on the basis of the number of employees and number of offices in each location. For Canadian-controlled private corporations claiming the small business deduction the net tax rate is 9. The maximum tax rate was 35.

Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to ease their business costs and to support their restructuring. 7 of taxable income above 83 100. 83 101 365 000.

Chargeable income MYR CIT rate for year of assessment 20212022. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate. The current CIT rates are provided in the following table.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. 15 Subject to Note 1 Surcharge. Combined corporate income tax rate.

From 1 July 2021 for 2021-22 and later periods the rate becomes 25. Data is also available for. Company with paid up capital not more than RM25 million.

Company Income Tax Rates. Otherwise the general company income tax rate is 30. YA 2019 Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1 On first RM500000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24 Non-resident company branch 24 Note 1.

Corporate income tax rate. 10 of taxable income if net income exceed 1 crore. 2 Companies availing benefit of lower tax rate under new provisions of sections 115BAA 115BAB have been Exempted from MAT on book profit under section 115JB.

These rebates are applicable for the Years of Assessment YAs 2013 to 2020. For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. Standard enterprise tax and local corporate special tax Enterprise tax is imposed on a corporations income allocated to each prefecture.

From 2016-17 to 2019-20 the small business company tax rate was 275 having been progressively lowered from 30 in 2014-15 and earlier years. Your company is taxed at a flat rate of 17 of its chargeable income. The effective tax rate for such companies shall be 2517 percent inclusive of surcharge and cess and provisions of.

Corporate income tax rate. The small business company tax rate for 2020-21 is 26. You want to figure out how much you owe in federal taxes.

0 of taxable income. 19 733 21 of taxable income above 365 000. This applies to both local and foreign companies.

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

Taxable Income Malaysia Eliezercxt

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

2018 Corporate Tax Rates Birch Accounting Tax Services Ltd

How Much Does A Small Business Pay In Taxes

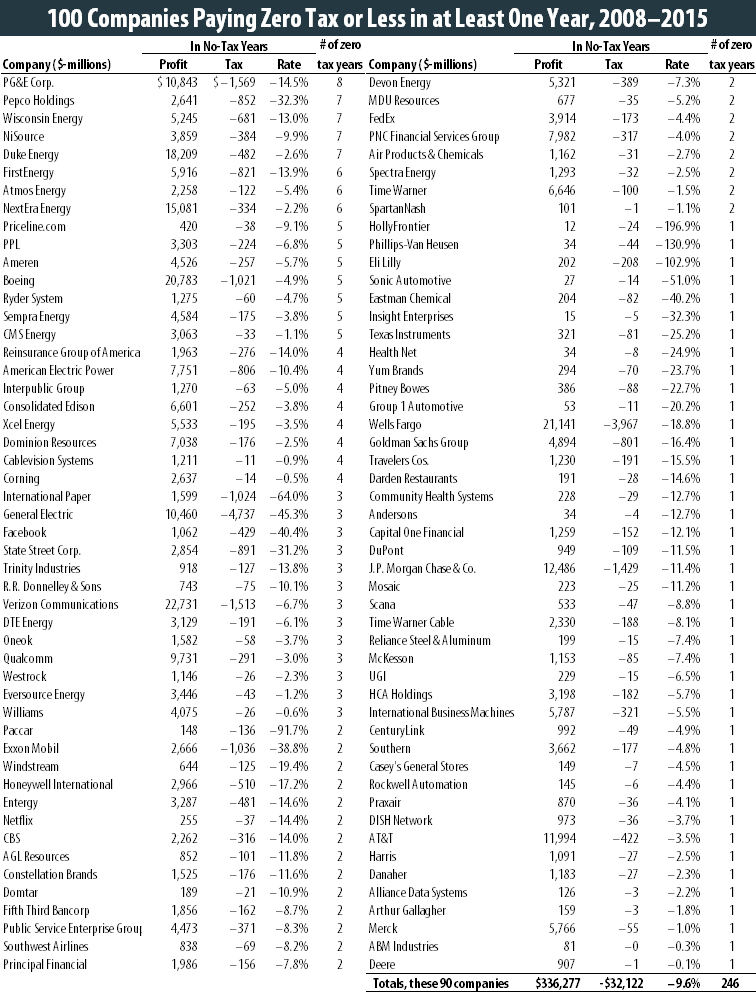

The 35 Percent Corporate Tax Myth Itep

Budget Fy19 Corporate Taxes Reduced For Banks And Financial Institutions Dhaka Tribune

Tax Principles Relx Information Based Analytics And Decision Tools

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Carbon Taxes Worldwide By Select Country 2021 Statista

Tax Proposals Comparisons And The Economy Tax Foundation

Who Pays U S Income Tax And How Much Pew Research Center

Weighted Average Cost Of Capital Wacc Formula Calculation Example

Who Pays U S Income Tax And How Much Pew Research Center

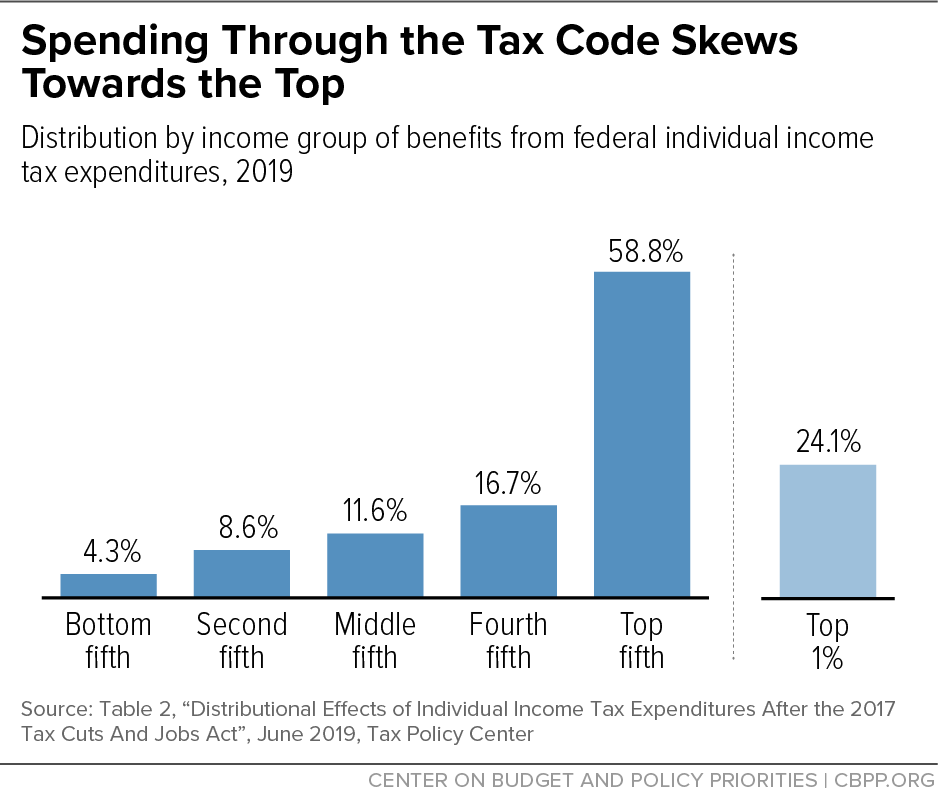

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

Oecd Corporate Tax Rate Update Tax Executive